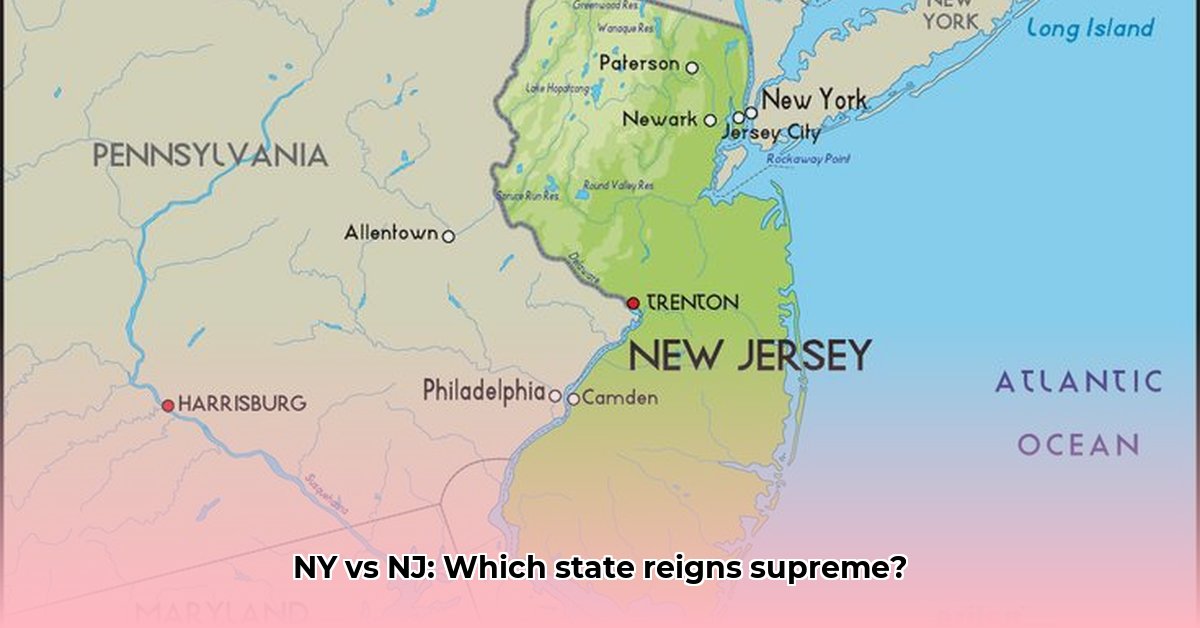

Have you ever considered the intricate relationship between New York and New Jersey? More than just neighboring states, they are intertwined by history, geography, economy, and environment. For a broader geographical perspective, check out this Southeast states map. Together we’ll explore their unique attributes, shared challenges, and the collaborative spirit that defines their future.

New York and New Jersey: A Tale of Two States

While sharing a border, New York and New Jersey boast distinct identities. A closer look reveals a captivating mix of rivalry and partnership, each state contributing to the dynamic Northeastern landscape. Let’s examine the historical, geographical, and economic factors that set them apart, as well as the areas where they collaborate for regional prosperity.

Geographical Contrasts: Size, Density, and Landscape

New York, with its expansive territory, showcases an impressive range of geographical features, from the Adirondack Mountains to the bustling metropolis of New York City. In contrast, New Jersey, despite being one of the smallest states, boasts a remarkable diversity of landscapes, including the Jersey Shore, the Pine Barrens, and the rolling hills of the northwest. This difference in size and landscape significantly affects population density and land use patterns, shaping the character of each state.

New Jersey’s high population density, the highest in the nation, leads to concentrated development and a unique urban-suburban dynamic. New York’s lower density, outside of New York City, allows for more open spaces and varied economic activities. Understanding these geographical distinctions sets the stage for appreciating the states’ diverging paths.

A Shared History, Divided by Disputes: The Border Story

The border between New York and New Jersey is not merely a line on a map; it’s a testament to historical disputes, evolving agreements, and the ongoing need for cooperation. From colonial-era conflicts over land and resources to more recent disagreements over maritime boundaries, the border’s history is rich with legal battles and negotiated settlements.

The “Oyster War” of the late 19th century, a dispute over oyster beds in Raritan Bay, exemplifies the challenges of defining and maintaining a border. Today, the states work together to manage shared resources and resolve cross-border issues through collaborative agreements and interstate compacts. Understanding this history is crucial for appreciating the present-day relationship.

Economic Interdependence: Complementary Strengths

New York’s economy, driven by finance, media, and technology, exerts a global influence. New Jersey’s economy, while smaller, possesses key strengths in pharmaceuticals, logistics, and telecommunications. These strengths are not isolated; they are interconnected, creating a regional economic ecosystem where each state benefits from the other’s presence.

Many companies maintain headquarters or major operations in New Jersey while leveraging New York City’s financial and media resources. This interdependence fosters innovation, job creation, and overall economic growth for the entire region.

Environmental Stewardship: Shared Challenges and Collaborative Solutions

The Hudson River, a vital waterway shared by both states, exemplifies the environmental challenges and opportunities they face. Pollution, habitat loss, and climate change threaten the river’s health and the well-being of the communities that depend on it.

New York and New Jersey have implemented joint initiatives to restore the Hudson River, protect coastal ecosystems, and promote sustainable practices. These collaborative efforts demonstrate a commitment to environmental stewardship and a recognition that shared challenges require shared solutions.

The Future of Collaboration: Building a Stronger Region

As the 21st century unfolds, New York and New Jersey face a future shaped by interconnectedness and interdependence. Transportation, infrastructure, economic development, and environmental protection require ongoing collaboration and a regional perspective.

Investments in public transit, such as the Gateway Program, aim to improve connectivity and reduce congestion between the states. Joint initiatives to promote renewable energy and address climate change demonstrate a shared commitment to a sustainable future. By working together, New York and New Jersey can unlock their full potential and create a more prosperous and resilient region.

Navigating the New York-New Jersey Business Tax Landscape: A Comprehensive Guide

Operating a business across state lines requires careful planning and a thorough understanding of each state’s tax regulations. This section provides a detailed guide to navigating the complexities of cross-border business taxation between New York and New Jersey.

Understanding the Key Differences in Tax Systems

New York and New Jersey have distinct tax systems with varying rates, rules, and regulations. Key differences include:

- Corporate Income Tax: New York’s corporate franchise tax applies to businesses operating within the state, while New Jersey levies a corporate business tax. The rates and structures of these taxes differ, requiring businesses to carefully calculate their liabilities in each state.

- Sales Tax: Both states impose sales taxes, but the rates, exemptions, and rules for collecting and remitting sales tax vary significantly. Businesses must accurately track sales and apply the appropriate tax rates based on the location of the transaction.

- Property Tax: Property taxes are levied at the local level in both states, and rates can vary widely depending on the location of the property. Businesses owning real estate in both states must understand the property tax laws and assessment procedures in each jurisdiction.

Establishing Nexus: Determining Tax Obligations

Nexus refers to the level of connection a business has with a state that triggers a tax obligation. Factors that can establish nexus include:

- Physical Presence: Having an office, warehouse, store, or other physical location in a state.

- Employees: Having employees who work or reside in a state.

- Sales Activity: Engaging in sales activities, such as soliciting orders or delivering goods, in a state.

If a business establishes nexus in both New York and New Jersey, it is required to file tax returns and pay taxes in both states.

Key Tax Considerations for Cross-Border Businesses

Businesses operating across the New York-New Jersey border must consider the following key tax issues:

- Allocation and Apportionment: Businesses with income from sources in both states must allocate and apportion their income to determine the amount taxable in each state.

- Transfer Pricing: Transactions between related entities operating in different states must be conducted at arm’s length to avoid tax shifting and potential penalties.

- Credits and Incentives: Both states offer various tax credits and incentives to businesses that invest in certain activities or industries. Businesses should explore these opportunities to reduce their tax liabilities.

Strategic Tax Planning for Multistate Businesses

- Choose the Right Entity Structure: The choice of entity structure, such as a corporation, partnership, or limited liability company (LLC), can have significant tax implications for businesses operating in multiple states.

- Consult with Tax Professionals: Seek advice from experienced tax advisors who can provide guidance on navigating the complexities of multistate taxation.

- Implement Proper Accounting Systems: Implement accounting systems that accurately track income, expenses, and sales by state to ensure accurate tax filings.

Common Pitfalls to Avoid

- Failing to register with the appropriate tax authorities in each state.

- Ignoring the sales tax regulations in one or both states.

- Not maintaining accurate books and records.

- Failing to properly allocate and apportion income between the states.

Mapping New Jersey: A Journey Through Geography, History, and Environment

New Jersey, often overshadowed by its larger neighbors, possesses a unique and compelling story. This section explores the state’s diverse geography, rich history, and environmental challenges.

Unveiling New Jersey’s Geographical Tapestry

New Jersey’s small size belies its diverse geography. From the sandy shores of the Atlantic coast to the rolling hills of the Piedmont region and the rugged terrain of the Highlands, the state offers a surprising variety of landscapes.

- The Atlantic Coastal Plain: This region covers the southern and eastern portions of the state and is characterized by sandy beaches, salt marshes, and pine forests.

- The Piedmont: Located in the north-central part of the state, the Piedmont is a region of rolling hills and fertile valleys.

- The Highlands: The Highlands region, also known as the New York-New Jersey Highlands, is a mountainous area in the northwestern part of the state.

A Historical Perspective: From Colonial Beginnings to Industrial Powerhouse

New Jersey’s history has shaped its geography and environment. From its colonial beginnings as a Dutch and Swedish settlement to its rapid industrialization in the 19th and 20th centuries, the state has undergone significant transformations.

The rise of manufacturing and transportation industries transformed New Jersey into a major economic center. However, this growth came at a cost, as pollution and environmental degradation became pressing concerns.

Environmental Challenges and Conservation Efforts

New Jersey faces a range of environmental challenges, including:

- Pollution: Industrial pollution, urban runoff, and agricultural activities have contaminated the state’s air, water, and soil.

- Habitat Loss: Development and urbanization have led to the loss of critical habitats for a variety of plant and animal species.

- Climate Change: Rising sea levels, increased flooding, and extreme weather events threaten New Jersey’s coastal communities and ecosystems.

Despite these challenges, New Jersey has implemented numerous conservation and remediation efforts to protect its environment. These efforts include:

- Superfund Program: The state has actively participated in the Superfund program to clean up hazardous waste sites.

- Coastal Management Programs: New Jersey has implemented coastal management programs to protect its shorelines and manage coastal development.

- Renewable Energy Initiatives: The state has set ambitious goals for renewable energy production and has implemented policies to promote solar, wind, and other clean energy sources.