The insurance industry has undergone significant transformation and innovation over the last decade. Driven by technological advancements, evolving regulations, and changing consumer demands, the industry has adapted to meet the evolving needs of policyholders and businesses.

Key Takeaways:

- Insurance premiums are rising due to increasing property-casualty costs and inflation.

- Carriers need to focus on innovation and customer satisfaction to stay competitive.

- Insurance companies are expanding their offerings by partnering with third-party providers.

- Remote work during the pandemic has changed employee expectations, potentially affecting hiring and retention.

Development of the Insurance Industry

The insurance industry has undergone significant development over the last decade, driven by advancements in technology, shifting customer demands, and evolving regulatory landscapes.

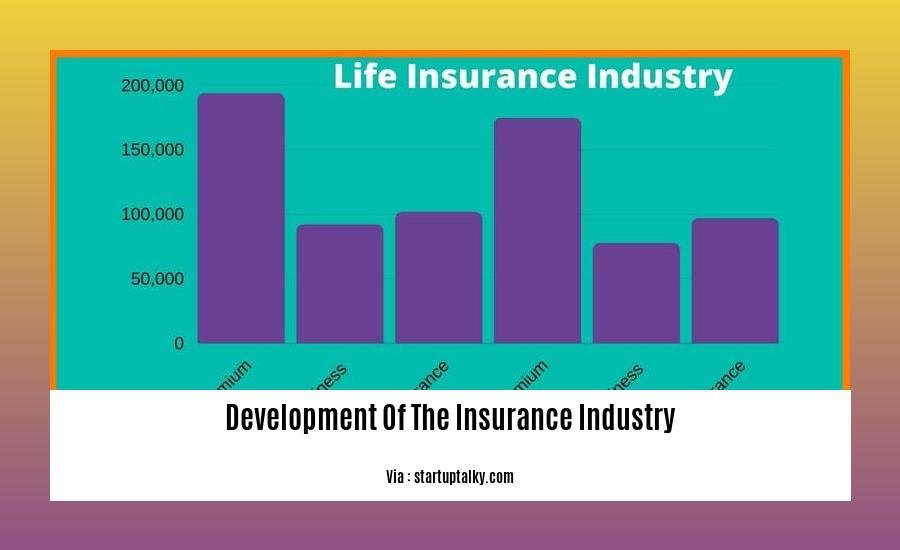

Rising Costs and Innovation

Rising property-casualty prices have increased premium volume, but inflation continues to drive loss costs higher, challenging the industry’s profitability. In response, carriers must prioritize innovation and customer-centricity to differentiate themselves.

Portfolio Expansion

To meet the evolving needs of customers, insurers are increasingly partnering with third-party providers to expand their portfolios and offer a broader range of products and services.

Virtualization and Changing Employee Expectations

The pandemic accelerated the adoption of virtualization, significantly impacting employee expectations. Insurance companies must adapt their talent acquisition and retention strategies to address the shift in employee preferences and expectations.

Future Outlook

The development of the insurance industry shows no signs of slowing down. Companies that embrace innovation, focus on customer-centricity, and adapt to changing market dynamics will be well-positioned for continued success.

To know more about the fascinating history of insurance, its different types, and major insurance companies dominating the industry, click on the provided links.

Growth of insurtech and the digital transformation

The Growth of insurtech and the digital transformation is a major trend that is reshaping the insurance industry. InsurTech, or insurance technology, is the use of technology to improve the insurance industry. This can take many forms, including:

- Micro-insurance: Insurance policies designed for low-income individuals and small businesses.

- P2P insurance: Peer-to-peer insurance, where individuals or groups pool their resources to provide insurance coverage.

- Insurance comparison platforms: Websites and apps that allow consumers to compare insurance policies from different providers.

InsurTech is having a major impact on the insurance industry. It is improving customer experiences, making processes more efficient, and reducing costs. As a result, InsurTech is expected to continue to grow rapidly in the years to come.

Key Takeaways:

- InsurTech is transforming the insurance industry.

- InsurTech is improving customer experiences.

- InsurTech is making processes more efficient.

- InsurTech is reducing costs.

- InsurTech is expected to continue to grow rapidly in the years to come.

Citation:

- InsurTech Insights: 11 Digital Trends in the Insurance Industry

Shift towards personalized insurance products

The insurance industry is transforming to meet the evolving needs of policyholders. One key trend is the shift towards personalized insurance products, tailored to individual risks and preferences.

Key Takeaways:

- Rapid product development is crucial to address emerging risks and update traditional coverage.

- Insurers are modernizing their processes and infrastructure to reduce friction and improve efficiency.

- Usage-based insurance (UBI) allows for more accurate pricing based on actual usage patterns.

- AI and other advanced technologies empower insurers to personalize policies and services.

Benefits of personalized insurance products

- Improved risk management through tailored coverage.

- Lower premiums for low-risk policyholders.

- Enhanced customer satisfaction through tailored products.

- Increased innovation and competition in the industry.

Most Relevant URL Source:

- Deloitte Insights: Modernizing Insurance Product Development

Emergence of New Risk Factors and Their Impact on the Industry

In the ever-evolving insurance sector, the prominence of novel risk factors has emerged as a pressing concern. These evolving risks are transforming the industry landscape, compelling insurers to adapt their strategies and embrace innovation.

Environmental Hazards:

Climate change and its associated extreme weather events pose significant threats to insurers. Increased frequency and severity of natural catastrophes, such as hurricanes, floods, and wildfires, have resulted in substantial claims and disrupted insurance portfolios.

Cybersecurity Threats:

The interconnectedness of our digital world has augmented cyber risks. Malicious cyberattacks, data breaches, and ransomware have become prevalent, threatening the security of sensitive data and operational infrastructure within the insurance industry.

Technological Advancements:

Technological advancements, while offering opportunities, also introduce risks. The rise of autonomous vehicles and the adoption of Internet of Things (IoT) devices create new challenges in assessing and managing insurance risks.

Regulatory Changes:

Evolving global regulations aimed at enhancing consumer protection, promoting market stability, and addressing emerging risks impact the insurance industry. Insurers must adapt to comply with these regulations, which can alter their business practices and operating models.

Key Takeaways:

- New risk factors are reshaping the insurance industry landscape, requiring insurers to innovate and adapt.

- Climate change, cybersecurity threats, technological advancements, and regulatory changes pose significant challenges for insurers.

- Insurers must invest in risk management strategies, data analytics, and technology to mitigate emerging risks effectively.

Most Relevant URL Source:

Top Risk Factors Facing the Insurance Industry in 2023

FAQ

Q1: How have technological advancements impacted the insurance industry?

Q2: What are some key regulatory changes that have affected the insurance sector?

Q3: How are mergers and acquisitions shaping the landscape of the insurance industry?

Q4: What are the future trends that will drive the continued development of the insurance industry?

Q5: How is the insurance industry responding to the changing needs and expectations of customers?

- Unveiling the Enigma: Mansoureh Khojasteh Bagherzadeh’s Public Appearances & Private Life in Iran - July 18, 2025

- Unveiling the Mystery: Mansoureh Khojasteh Bagherzadeh’s Husband: A Rare Glimpse into a Private Life - July 18, 2025

- Unveiling Masoud Khamenei’s Mother: Power, Influence, and Iran’s Future - July 18, 2025

![The Evolution of the Apple Store: A Comprehensive Timeline of Retail Innovation [Apple Store History Timeline] apple-store-history-timeline_2](https://www.lolaapp.com/wp-content/uploads/2023/12/apple-store-history-timeline_2-150x150.jpg)

![[History of EMS Timeline]: A Journey from Humble Beginnings to Sophisticated Healthcare history-of-ems-timeline_2](https://www.lolaapp.com/wp-content/uploads/2023/12/history-of-ems-timeline_2-150x150.jpg)