Welcome to “What Is Payment Environment: Demystifying the World of Transactions,” your comprehensive guide to the intricate ecosystem that powers our daily purchases. Join us as we unravel the complexities of payment processing, exploring traditional methods and emerging digital solutions that are revolutionizing the way we transact. Embrace the ever-changing landscape of payment services with us, as we delve into infrastructure, security protocols, and regulatory frameworks, making this multifaceted world accessible to all.

Key Takeaways:

- Definition: Payment processing is the secure movement of funds from a payer to a payee using electronic systems.

- Key Players:

- Merchant (customer collects payment information)

- Processor (sends transaction to issuing bank)

- Issuing bank (verifies funds)

- Acquiring bank (ensures funds are transferred)

- Importance:

- Streamlines business operations

- Increases customer convenience and trust

- Reduces fraud and chargebacks

What Is Payment Environment

The payment environment encompasses the diverse landscape of systems, processes, and technologies involved in facilitating monetary transactions. It comprises a complex ecosystem that bridges payers and payees, enabling the seamless transfer of funds.

Components of the Payment Environment

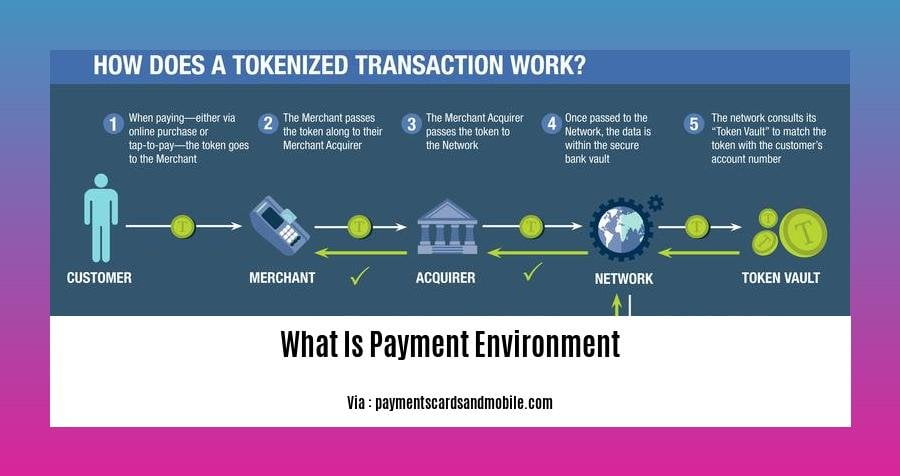

Transaction Initiation: The process begins when a customer initiates a payment, typically entering their payment information.

Payment Gateway: This serves as the intermediary, routing the transaction to the customer’s issuing bank.

Transaction Authorization: The issuing bank verifies that the customer has sufficient funds available to cover the transaction.

Issuing-Bank Verification: The issuing bank confirms the availability of funds and returns an authorization code.

Payment Processor: This processes the transaction and facilitates the flow of funds between the issuing bank and the merchant’s acquiring bank.

Importance of the Payment Environment

The payment environment plays a crucial role in modern commerce:

- Streamlines Business Transactions: It enables businesses to accept payments efficiently and securely.

- Improves Customer Convenience: Digital payment solutions offer ease and convenience to customers.

- Protects Against Fraud: Advanced security measures minimize the risk of fraudulent transactions.

Types of Payment Methods

The payment environment offers a variety of payment methods:

- Traditional Methods: Cash, checks, and cards.

- Alternative Payment Methods: Electronic wallets, mobile payments, and peer-to-peer platforms.

- Emerging Payment Technologies: Biometric authentication, cryptocurrency, and wearable payment devices.

Benefits of the Payment Environment

The payment environment provides numerous advantages:

- Convenience: Digital payment options offer flexibility and accessibility.

- Security: Encryption and fraud prevention measures safeguard financial information.

- Growth Opportunities: Innovative payment technologies expand payment options, stimulating economic growth.

Future of the Payment Environment

The payment environment is constantly evolving, driven by technological advancements:

- Digitalization: The adoption of digital payment methods is increasing rapidly.

- Biometric Authentication: Security measures are being enhanced with biometric technologies.

- Contactless Payments: Touchless payment options provide convenience and hygiene benefits.

- Embedded Finance: Payment capabilities are being integrated into non-financial platforms.

If you’re curious about the development of payment strategies for preserving the environment, discover the history of payment for environmental services. Delve into the origins and evolution of this concept, exploring its role in fostering sustainable practices.

Learn about the History Of Payment For Ecosystem Services and how it has transformed the way we value and protect our natural environment. Discover how PES schemes have evolved over time, and the impact they have had on conservation efforts globally.

Explore the multifaceted concept of Payments For Environmental Services and its implications for environmental conservation. Delve into the various types of PES schemes, their benefits, and the challenges they face in promoting sustainable land management practices.

Gain a comprehensive understanding of What Is Environmental Services and their crucial role in sustaining human well-being. Discover the diverse range of services provided by nature, from air and water purification to biodiversity conservation, and explore the importance of preserving these essential functions.

Delve into the dynamic field of Environmental Services Hourly Pay and uncover the earning potential and career opportunities in this growing industry. Discover the factors that influence salary expectations, including education, experience, and specialization, and explore the various sectors where environmental services professionals can make a meaningful contribution.

--

Security Protocols: Ensuring Trust and Protection

In the world of payments, trust and protection are paramount. Security protocols play a pivotal role in safeguarding your sensitive financial information during transactions. Let’s delve into these protocols and how they ensure peace of mind:

Encryption:

Think of encryption as a secret code that transforms data into an unreadable format. When you enter your payment details, encryption scrambles the data, making it incomprehensible to unauthorized eyes.

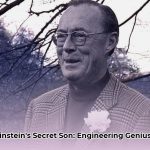

Tokenization:

Instead of storing your actual card number, tokenization replaces it with a unique token. This token acts as a substitute during transactions, protecting your sensitive information from compromise.

Authentication:

Authentication ensures that the person making the payment is who they claim to be. It verifies your identity through methods like PINs, passwords, or biometric recognition.

Fraud Detection and Prevention:

Advanced algorithms monitor transaction patterns and flag suspicious activities. These systems detect anomalies that may indicate fraudulent attempts, protecting you from unauthorized charges.

PCI DSS Compliance:

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security measures businesses must follow to protect customer payment data. It helps ensure that personal and financial information is handled securely throughout the payment process.

Key Takeaways:

- Encryption scrambles sensitive data, protecting it from unauthorized access.

- Tokenization replaces card numbers with unique tokens, safeguarding your payment information.

- Authentication verifies the identity of users, preventing unauthorized access.

- Fraud detection algorithms monitor transaction patterns to identify suspicious activities.

- PCI DSS compliance ensures secure handling of payment data by businesses.

Citation:

Regulatory Frameworks: Navigating the Compliance Landscape

Navigating the ever-changing landscape of payment processing regulations can be a daunting task. As a seasoned professional, I’ll provide insights into Regulatory Frameworks: Navigating the Compliance Landscape, enabling you to stay compliant and secure.

The Importance of Compliance

Compliance with governing regulations is paramount to ensure the protection of sensitive data and mitigate financial risks. Ignorance of regulations can lead to penalties, reputational damage, and even criminal charges. Understanding and implementing effective compliance measures is crucial for the stability and growth of any payment processing business.

Steps to Navigate Regulatory Compliance

- Identify Applicable Regulations: Determine which regulations apply to your business based on factors such as geographical location and payment methods offered.

- Establish Compliance Policies: Develop comprehensive policies and procedures to meet regulatory requirements, including data security, privacy, and anti-money laundering measures.

- Implement Robust Security Measures: Employ robust security protocols to safeguard customer data, such as encryption, tokenization, and fraud detection mechanisms.

- Train Staff: Educate and train staff on compliance responsibilities to ensure consistent implementation across the organization.

- Monitor for Regulatory Changes: Stay abreast of evolving regulations and industry best practices to ensure ongoing compliance.

Benefits of Compliance

Compliance brings numerous benefits, including:

- Minimized risk of penalties and legal repercussions

- Enhanced customer trust and loyalty

- Improved operational efficiency and cost savings

- Competitive advantage in the payment processing industry

Key Takeaways:

- Compliance with regulations is essential for payment processing businesses.

- Understanding applicable regulations and implementing effective policies is crucial.

- Robust security measures protect customer data and mitigate risks.

- Continuous monitoring and staff training are essential for ongoing compliance.

- Compliance brings numerous benefits, including reduced risk, enhanced trust, improved efficiency, and competitive advantage.

Relevant URL Sources:

- Payment Processing and Compliance: Navigating the Regulatory Landscape

- Navigating Regulatory Requirements: Acing Compliance

FAQ

Q1: What is payment processing?

A1: Payment processing refers to the secure electronic transfer of funds between parties, involving a payment gateway, issuing bank, and acquiring bank.

Q2: What are the key components of a payment system?

A2: A payment system typically encompasses rules, institutions, networks, and software that facilitate the processing and settlement of payments.

Q3: How does payment security safeguard sensitive data?

A3: Payment security employs encryption, tokenization, authentication, fraud detection, and PCI DSS compliance to protect sensitive payment information from unauthorized access or breaches.

Q4: Why is it crucial to comply with payment processing regulations?

A4: Adhering to regulations ensures compliance with industry standards, such as PSD2, PCI DSS, and GDPR, safeguarding customer data and maintaining the integrity of payment systems.

Q5: What are the benefits of payment modernization?

A5: Payment modernization brings increased efficiency, speed, security, and enhanced customer experience, paving the way for cashless transactions and digital payment innovations.

- Unveiling Bernhard Caesar Einstein’s Scientific Achievements: A Legacy in Engineering - July 15, 2025

- Uncover who is Jerry McSorley: CEO, Family Man, Business Success Story - July 15, 2025

- Discover Bernhard Caesar Einstein’s Scientific Contributions: Unveiling a Legacy Beyond Einstein - July 15, 2025

![The Evolution of the Apple Store: A Comprehensive Timeline of Retail Innovation [Apple Store History Timeline] apple-store-history-timeline_2](https://www.lolaapp.com/wp-content/uploads/2023/12/apple-store-history-timeline_2-150x150.jpg)