Want to invest like Warren Buffett? It’s not just about crunching numbers; it’s about adopting a mindset. Warren Buffett’s best quotes offer a surprisingly accessible window into his investment philosophy, risk management, and business acumen. They’re more than just soundbites; they’re distillations of decades of experience.

At a glance:

- Learn the core principles behind Buffett’s investment strategy, from value investing to the “circle of competence.”

- Discover how to apply Buffett’s risk management wisdom to protect your portfolio.

- Uncover the simple truths that guide Buffett’s business decisions.

- Understand how Buffett’s quotes reveal his long-term perspective and temperament.

- Identify common misconceptions about Buffett’s investment style.

The Foundation: Value Investing & A Margin of Safety

Many of Warren Buffett’s best quotes revolve around value investing – the cornerstone of his success. This isn’t just about buying cheap stocks; it’s about buying undervalued companies. This involves determining a company’s intrinsic value, what it’s truly worth independent of its current market price.

Quote Snapshot: “Price is what you pay. Value is what you get.”

Practical Application: Before buying any stock, try to estimate its intrinsic value. Read company reports, analyze financial statements, and understand the business model. Compare your valuation to the current market price. The larger the gap between price and value, the greater your “margin of safety.”

Buffett learned a key lesson from his mentor, Benjamin Graham: always invest with a margin of safety. This buffer protects you from errors in your valuation and unexpected events.

Quote Snapshot: “Risk comes from not knowing what you’re doing.”

Practical Application: Don’t invest in businesses you don’t understand, no matter how tempting the potential returns. Stick to your “circle of competence.” If you can’t explain a company’s business model in simple terms, it’s probably outside your comfort zone. Learn about Warren Buffett.

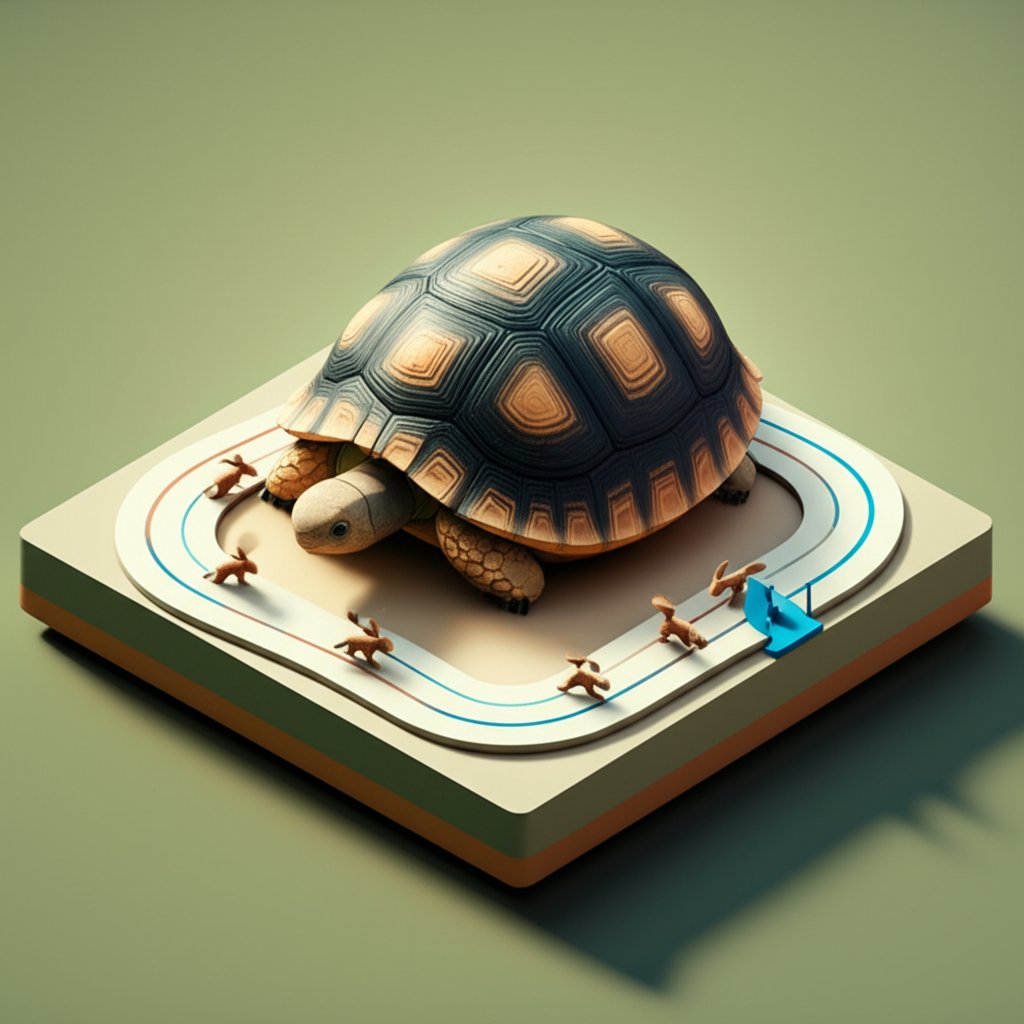

The Power of Patience: Playing the Long Game

Buffett isn’t a day trader. He’s a long-term investor, and many of Warren Buffett’s best quotes emphasize the importance of patience. He looks for companies with enduring competitive advantages and holds them for years, even decades.

Quote Snapshot: “Our favorite holding period is forever.”

Practical Application: When you find a great company, don’t be quick to sell. Focus on the long-term prospects of the business, not short-term market fluctuations. Avoid emotional decisions driven by fear or greed.

Quote Snapshot: “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Practical Application: Long-term investments require patience and foresight. The rewards may not be immediate, but they can be substantial over time. Think about the long-term consequences of your investment decisions.

Example: Buffett’s investment in Coca-Cola. He initially invested in 1988 and has held the stock ever since, reaping significant returns over the decades. This wasn’t a quick trade; it was a long-term bet on a strong brand and a simple business model.

Moats and Management: Investing in Quality Businesses

Buffett looks for companies with “economic moats” – sustainable competitive advantages that protect them from competitors. These moats can take many forms, such as strong brands, patented technology, or a dominant market share. He also prioritizes companies with honest and capable management teams.

Quote Snapshot: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Practical Application: Focus on quality over cheapness. A strong company with a competitive advantage is more likely to generate consistent returns over the long term, even if it trades at a premium.

Quote Snapshot: “I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

Practical Application: Look for businesses that are simple and easy to understand. The less reliant a company is on exceptional management, the more likely it is to succeed in the long run. While he values strong leadership, the core business model should be resilient.

How To Spot a Moat:

- Brand Recognition: Does the company have a strong brand that customers trust and are willing to pay a premium for? (Example: Apple)

- Switching Costs: Is it difficult or expensive for customers to switch to a competitor’s product or service? (Example: Enterprise software with complex integrations)

- Network Effect: Does the value of the product or service increase as more people use it? (Example: Social media platforms)

- Cost Advantage: Does the company have a unique ability to produce goods or services at a lower cost than its competitors? (Example: Walmart’s supply chain efficiency)

Temperament Over IQ: Controlling Your Emotions

Buffett believes that temperament is more important than IQ when it comes to investing. The ability to control your emotions and think rationally is crucial for making sound investment decisions.

Quote Snapshot: “The most important quality for an investor is temperament, not intellect.”

Practical Application: Avoid emotional decision-making. Fear and greed can lead to impulsive buying and selling, which can erode your returns. Develop a disciplined investment strategy and stick to it, even during market volatility.

Quote Snapshot: “Be fearful when others are greedy and greedy when others are fearful.”

Practical Application: This is a classic Buffett quote that highlights the importance of contrarian thinking. When the market is euphoric, be cautious. When the market is panicking, look for opportunities to buy undervalued assets.

Risk Management: Protecting Your Downside

Buffett is a master of risk management. He understands that preserving capital is just as important as generating returns. Many of Warren Buffett’s best quotes touch on this crucial aspect of investing.

Quote Snapshot: “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.”

Practical Application: Focus on protecting your downside. Avoid risky investments that could lead to significant losses. Diversify your portfolio, but not to the point where you don’t understand your investments.

Quote Snapshot: “Wide diversification is only required when investors do not understand what they are doing.”

Practical Application: Don’t diversify for the sake of diversification. Focus on investing in a smaller number of companies that you understand well. This allows you to conduct thorough research and make informed decisions.

Buffett’s Practical Playbook: Start Investing Like The Oracle

- Define Your Circle of Competence: List the industries and business models you understand well. Focus your investments within this area.

- Calculate Intrinsic Value: Learn how to analyze financial statements and estimate the intrinsic value of a company. Use metrics such as P/E ratio, return on equity, and free cash flow.

- Look for Moats: Identify companies with sustainable competitive advantages that protect them from competitors.

- Assess Management: Evaluate the honesty and competence of the company’s management team. Look for leaders with a track record of creating value for shareholders.

- Establish a Margin of Safety: Only invest when the market price is significantly below your estimate of intrinsic value.

- Be Patient: Hold your investments for the long term, focusing on the underlying business performance rather than short-term market fluctuations.

- Control Your Emotions: Avoid making impulsive decisions driven by fear or greed. Stick to your investment strategy.

Quick Answers: Common Questions About Buffett’s Quotes

Q: Is Buffett’s advice still relevant in today’s market?

A: Absolutely. While the market landscape has changed, the fundamental principles of value investing, risk management, and long-term thinking remain timeless. Buffett’s emphasis on understanding businesses, buying with a margin of safety, and controlling emotions is as relevant today as it was decades ago.

Q: What if I don’t have a lot of money to invest?

A: You can still apply Buffett’s principles. Start small, invest regularly, and focus on building a diversified portfolio of high-quality companies over time. Compounding is a powerful force, even with small amounts.

Q: Buffett missed out on the early tech boom. Does this mean his strategy is flawed?

A: Buffett has admitted to missing some opportunities in the technology sector early on. However, he has also stated that he prefers to invest in businesses he fully understands. While he may have missed out on some gains, his disciplined approach has also helped him avoid significant losses. He later invested successfully in Apple, demonstrating his adaptability.

Q: How can I learn more about value investing?

A: Start by reading books by Benjamin Graham (“The Intelligent Investor”) and Warren Buffett’s shareholder letters. Practice analyzing financial statements and valuing companies. Consider taking online courses or workshops on value investing.

Start Applying Buffett’s Wisdom Today

Warren Buffett’s best quotes offer valuable insights into the mind of one of the world’s most successful investors. By understanding and applying these principles, you can improve your investment results and achieve your financial goals. Remember that investing is a marathon, not a sprint. Patience, discipline, and a long-term perspective are key to success.