The world of cryptocurrency can feel like an exclusive group, brimming with perplexing jargon and insider phrases. Understanding the important quotes and sayings circulating around crypto is like possessing a cheat sheet for intelligent investing. This guide dissects the most common crypto quotes, clarifying their true meanings and demonstrating how to utilize them for enhanced decision-making. Whether you’re a novice or possess prior experience, we’ll illustrate how to distinguish between background noise and valuable information, transforming enigmatic pronouncements into actionable advice to navigate this thrilling yet occasionally complex market. For help understanding price quotes, check out this helpful guide: reading crypto quotes.

Crypto Quote Meaning: Cracking the Code of Crypto Talk

So you’re diving into the world of cryptocurrency, exploring crypto quote meaning? Great! But be prepared for a whole new language. Crypto enthusiasts have a way of expressing themselves, using short, catchy phrases that pack a lot of meaning. Let’s decode some of this cryptic crypto-speak and analyze market sentiment.

Riding the Rollercoaster: Bull and Bear Markets – Understanding Market Fluctuations

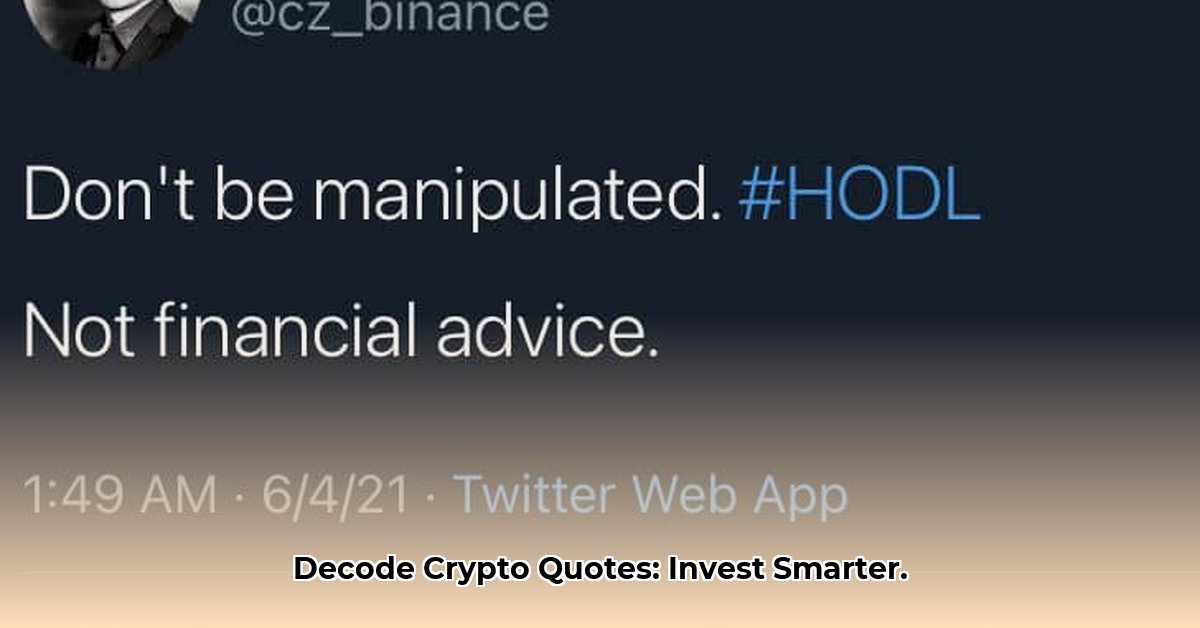

The crypto market is famous – or infamous, depending on your perspective – for its wild swings. One minute you’re soaring high, the next you’re plummeting. This volatility is reflected in the lingo. You’ll often hear “hodl” (a misspelling of “hold,” born from a hilarious typo), which basically means hanging tough, sticking with your investments even when things get rough. This is the mantra of the long-term investor, the one who believes in the long game, despite market volatility.

On the flip side, there’s the exhilarating cry of “to the moon!” This is the battle cry of the bull market, predicting massive price increases. It’s the pure, unadulterated optimism that fuels the crypto dream.

What does this tell us? These phrases reflect the inherent risks and rewards. “Hodl” speaks to patience and resilience – essential traits for navigating market ups and downs. “To the moon!” reflects the potential for huge profits, but also the potential for equally huge losses. Both mindsets are valid, depending on your investment strategy and how comfortable you are with risk. It all depends on your personal risk tolerance and investment timeline. Understanding market trends is key.

Decentralization: The Big Idea (and Its Challenges) – Blockchain Technology Explained

Many crypto sayings circle back to the core principle of blockchain: decentralization. What does that really mean? It means the system isn’t controlled by one big boss, like a bank. Instead, it’s spread out across a network of computers. This distributed nature is seen as a major advantage. It makes the system more resistant to manipulation, censorship, and single points of failure. The phrase “trustless system” highlights this – your transactions are secure without relying on a single entity to vouch for their validity.

But is decentralization always better? Like most things, it’s not so simple. While it offers great security, decentralization also brings complexity. Regulating and overseeing something so widely distributed can be a nightmare, and the absence of a central authority can create unique security vulnerabilities. It’s a double-edged sword. The idea sounds great, but its practical implications are still being figured out, and regulatory compliance becomes difficult.

Navigating the Regulatory Landscape: Rules of the Game – Understanding Legal Standards

The rules of the crypto game are constantly changing. Governments worldwide are trying to figure out how to regulate this new technology. This uncertainty often shows up in the language used. Phrases like “KYC compliant” (Know Your Customer) and “AML compliant” (Anti-Money Laundering) show the industry’s attempts to meet legal standards and ensure responsible financial practices. These regulations are designed to protect investors and prevent illegal activities such as money laundering, but they also often add layers of complexity to investing in crypto, creating uncertainty about future regulations.

How does this affect you? Regulatory clarity brings stability and encourages investment. Uncertainty, on the other hand, can make the market volatile and unpredictable. Staying informed about the latest regulations is absolutely essential. Understanding the legal implications behind what people say in the crypto world is a crucial step to making informed decisions.

Crypto Jargon: A Quick Guide – Key Terms Overview

Here’s a handy table summarizing some common crypto terms:

| Quote | Meaning | What it means for you |

|---|---|---|

| Hodl | Hold on for dear life; long-term investment strategy | Patience, resilience, and understanding that the market fluctuates are key. |

| To the moon! | Expecting a rapid price increase; bullish sentiment | High potential for profit (and correspondingly high risk) |

| Decentralized | Not controlled by a single entity; distributed ledger technology | Offers potential for greater security and resistance to censorship. |

| Trustless System | A system that operates without needing trust in a central authority | Enhanced security from lack of centralized control. |

| KYC/AML Compliant | Adheres to Know Your Customer and Anti-Money Laundering regulations | Shows that providers are striving to comply with legal requirements. |

This isn’t an exhaustive list, but it gives you a head start. As you delve deeper into the crypto world, you’ll encounter even more colorful phrases. Remember, understanding these cryptic expressions isn’t just about sounding like an insider; it’s about navigating the market intelligently and making informed investment decisions. This evolving language reflects the dynamic and sometimes unpredictable nature of the crypto world. Keep learning and stay tuned, because the crypto conversation is constantly evolving as we understand digital assets.

How to Mitigate Regulatory Risks in Cryptocurrency Investments

Key Takeaways:

- The cryptocurrency market offers substantial investment potential but also carries considerable legal and regulatory risks.

- Robust due diligence, regulatory compliance, and security are crucial for mitigating these risks.

- Regulatory landscapes vary significantly across jurisdictions, creating uncertainty for global investors.

Understanding the Regulatory Landscape – Global Regulations

Navigating the cryptocurrency world feels like charting unmapped territory. The lack of a unified global regulatory framework is a major hurdle. Different countries have different rules, creating uncertainty for investors. Think of it like trying to drive across the country with constantly changing speed limits and road rules – it’s confusing and potentially dangerous. How to mitigate regulatory risks in cryptocurrency investments is a critical question for anyone involved in virtual currency.

According to a report by the Congressional Research Service, the U.S. approach to crypto regulation is still developing, with various agencies claiming jurisdiction. This fragmented approach adds to the complexity and uncertainty for businesses operating in the crypto space.

Due Diligence: Your First Line of Defense – Research and Analysis

Before investing, thorough research is non-negotiable. Assess the project’s underlying technology, team, and market viability. This is akin to carefully inspecting a house before buying it; you wouldn’t purchase a property without checking for structural issues. Scrutinize whitepapers, examine the team’s background, and look for red flags. Don’t just rely on hype; investigate independently to understand investment strategies.

For example, examine the tokenomics of a cryptocurrency: What is the total supply? How is it distributed? Are there mechanisms to control inflation? A well-designed tokenomic model can be a positive indicator, while a poorly designed one can signal potential risks.

Security Best Practices: Protecting Your Assets – Secure Wallets

Cryptocurrency security is paramount. Use reputable, secure wallets and exchanges. Think of these as your bank vaults; securing them is vital to keeping your money safe. Enable two-factor authentication (2FA) and regularly update your software. Diversify your holdings across multiple platforms to reduce the impact of a potential security breach. This prevents putting all your digital eggs in one basket, protecting your digital assets.

Consider hardware wallets, also known as cold storage, which store your private keys offline, making them less vulnerable to hacking. Examples include Ledger and Trezor.

Continuous Monitoring and Adaptation – Staying Updated

The crypto space is dynamic and constantly evolving. Regulatory changes and technological advancements are happening all the time. Regularly monitor regulatory developments, and stay abreast of new technologies. You need to stay on your toes to avoid being caught off guard. Consider subscribing to newsletters, following reputable news sources, and engaging with knowledgeable communities while understanding technical analysis.

Follow organizations like the Blockchain Association and Coin Center for updates on regulatory developments and policy discussions.

Legal and Financial Advice: Seeking Expert Guidance – Professional Help

Don’t hesitate to seek professional legal and financial advice. Navigating the complex legal landscape can be overwhelming. They can offer tailored guidance about your specific investment goals and risk tolerance. Consider it investing in your own security, as financial advisors can help.

A qualified attorney specializing in cryptocurrency law can advise on compliance requirements and potential legal liabilities.

Long-Term Strategies for Success – Diversification

Long-term success requires diversification. Don’t put all your money into one cryptocurrency or even just cryptocurrencies themselves. Diversification is a basic investment principle, whether you are in crypto or traditional markets. Actively manage your risk exposure, and monitor your investment portfolio. Stay informed about future technological trends for long-term financial planning.

Consider diversifying into different asset classes, such as stocks, bonds, and real estate, to reduce your overall risk exposure.

Cryptocurrency Quote Applications in Algorithmic Trading Strategies

Key Takeaways:

- Algorithmic

- Uncover Timeless Ancient Greece Female Names: A Guide to Choosing the Perfect Name - August 9, 2025

- Explore Ancient Greece Artifacts: Unveiling Iconic Treasures - August 9, 2025

- Unveiling Ancient Greek Marriage: Customs & Laws Revealed - August 9, 2025

1 thought on “Unlock crypto quote meaning: Expert analysis for smart investing”

Comments are closed.